TLDR: Nicola Peltz’s family is worth between $1.6 billion and $1.8 billion, roughly matching the Beckham family’s $900 million to $1.2 billion fortune. Her father Nelson Peltz built his wealth through aggressive corporate activism and legendary deals like flipping Snapple for a $1 billion profit.

With a $372 million Palm Beach estate, control of an $8.5 billion hedge fund, and Nicola’s own $50 million net worth, the Peltz dynasty represents a fundamentally different type of wealth than the Beckhams’ celebrity empire.

The difference isn’t just the numbers, it’s industrial capital versus brand power.

When Nicola Peltz married Brooklyn Beckham in a lavish $4 million ceremony at her family’s Palm Beach estate in 2022, the media framed it as a merger of equals. Two wealthy dynasties coming together. And financially, they’re closer than you might think.

The Peltz family fortune sits between $1.6 billion and $1.8 billion, while the Beckham empire has grown to an estimated $900 million to $1.2 billion. The numbers are comparable, but the nature of the wealth couldn’t be more different.

While David and Victoria Beckham have built an impressive empire worth between $900 million and $1.2 billion through strategic business moves, Inter Miami ownership, and brand deals, Nicola’s father Nelson Peltz controls a financial machine in the same ballpark.

But here’s what matters: the Peltz wealth operates on fundamentally different principles. This isn’t celebrity money built on endorsements and Instagram followers. This is industrial capital, hedge fund power, and generational wealth designed to compound for centuries.

The marriage united two powerful families, but the architecture of their wealth reveals why the reported “family feud” tensions make sense.

When you’re dealing with families operating at this level, the question isn’t just how much money they have. It’s how that money works, where it comes from, and whether it’s built to last.

Nelson Peltz: From Wharton Dropout to Billionaire Corporate Raider

Nelson Peltz didn’t inherit his fortune or stumble into it through viral fame. He built it the hard way, through decades of aggressive corporate restructuring that earned him a reputation as one of Wall Street’s most feared activist investors.

His journey started in 1963 when he dropped out of the prestigious Wharton School at the University of Pennsylvania to join his family’s wholesale food distribution business, A. Peltz & Sons.

He started as a delivery driver. Over fifteen years, he grew the regional business into a public company and eventually sold it to build his initial capital base. But the real explosion of wealth came during the 1980s leveraged buyout boom.

Partnering with Peter May, Peltz acquired Triangle Industries, a small packaging firm, and used high-yield debt (the infamous junk bonds of that era) to execute a roll-up strategy, gobbling up larger competitors like National Can.

By the late 1980s, Triangle had become a Fortune 100 company and the largest packaging firm in the world. When Peltz sold it to French conglomerate Pechiney in 1988, the deal generated hundreds of millions in profit.

This was the liquidity event that allowed the family to start acquiring their trophy real estate, including the Palm Beach estate that would eventually be worth more than many public companies.

The Snapple Deal That Made Peltz a Legend

If Triangle provided the capital, the Snapple transaction provided the legend. In the late 1990s, through his holding company Triarc, Peltz did something that still gets taught in business schools.

He bought the Snapple beverage brand from Quaker Oats for just $300 million.

Quaker had famously destroyed the brand through mismanagement, corporate bureaucracy, and tone-deaf marketing that stripped away everything quirky and authentic about Snapple.

Peltz saw the opportunity everyone else missed. He brought back the brand’s offbeat personality, restored relationships with distributors, and executed a brilliant marketing turnaround. Three years later, in 2000, he sold Snapple to Cadbury Schweppes for $1.45 billion.

That’s a $1.15 billion profit on a three-year investment. This single deal alone generated enough wealth to ensure financial security for his children, including Nicola (born in 1995), for multiple generations.

The Snapple arbitrage demonstrated Peltz’s core strategy: buy undervalued assets, fix operational inefficiencies, and sell at peak value.

It’s a strategy he’s replicated dozens of times since, cementing his status as one of the most successful activist investors in American finance.

Trian Fund Management: The $8.5 Billion War Chest

Today, Nelson Peltz’s wealth isn’t sitting in a bank account collecting interest. It’s actively deployed through Trian Fund Management, the activist hedge fund he founded in 2005.

Trian manages approximately $8.5 billion in assets, buying large stakes in underperforming public companies and forcing operational changes through board seats and shareholder pressure.

This structure generates wealth in two ways. First, the Peltz family invests its own capital alongside outside investors, earning returns on the fund’s performance.

Second, hedge funds charge hefty fees. A typical structure includes a 2% annual management fee and a 20% performance fee on profits. On $8.5 billion under management, the management fees alone generate over $100 million annually.

That’s the money funding the private jets, the 130-acre estate, the ice rink, and the $4 million weddings.

Peltz’s corporate battles are the stuff of Wall Street legend. He currently owns a massive stake in Wendy’s worth approximately $266 million and serves as non-executive chairman, effectively controlling the fast-food chain’s board strategy.

He won the largest proxy fight in corporate history against Procter & Gamble, securing a board seat and pushing through restructuring that unlocked billions in shareholder value. His fund’s stake in P&G alone was worth about $3.5 billion at its peak.

In 2024, Peltz launched an aggressive proxy battle against Disney, demanding board seats and strategic changes. While he eventually sold his stake after the fight, the campaign likely netted him substantial profits from the share price volatility.

He’s also served on the boards of Sysco and Unilever, pushing for breakups and reorganizations that maximize shareholder returns.

The genius of Peltz’s approach is his focus on consumer staples. People eat at Wendy’s, use Procter & Gamble products, and buy Heinz ketchup regardless of whether the economy is booming or in recession.

This defensive positioning means the Peltz fortune is largely insulated from the kind of market volatility that can evaporate tech wealth overnight.

The Real Estate Empire: A $372 Million Compound and More

If Trian is the engine of the Peltz fortune, the real estate portfolio is its fortress. The family’s property holdings have appreciated at rates that make stock market returns look mediocre, acting as massive stores of value that are simultaneously functional homes and financial assets.

The crown jewel is Montsorrel, the oceanfront estate in Palm Beach, Florida, where Nicola and Brooklyn held their wedding. The family began assembling this compound in 1987, purchasing the main house for $13.5 million and an adjacent property for $3 million. At the time, these were record-breaking prices for Palm Beach real estate.

Today, after decades of renovations and the COVID-era migration of billionaires to Florida, Montsorrel is valued at over $372 million. The estate spans 13.1 acres of oceanfront land featuring a 40,700 square foot Regency-style mansion, guest houses, professional tennis courts, basketball courts, swimming pools, and direct beach access.

That’s an appreciation of roughly 1,700% over 35 years. The estate is now worth more than the entire market capitalization of many publicly traded companies.

Montsorrel isn’t just a status symbol. Financial records show Nelson and Claudia Peltz secured a $68.5 million mortgage against the property from Bank of America.

Why borrow money when you’re worth billions? Because ultra-wealthy individuals use real estate-backed lending to access cash without selling appreciating assets.

The interest is often tax-deductible and the rates are lower than the capital gains taxes they’d pay if they liquidated stock holdings. It’s sophisticated balance sheet management that maximizes liquidity while minimizing tax liability.

The family’s primary residence in the Northeast is High Winds, a 130-acre estate in Bedford, New York, purchased in the late 1980s for about $6 million. In the context of the New York metro area, owning a contiguous 130-acre property is almost unheard of.

The estate features a 27-room mansion, a private indoor ice hockey rink (Nelson is a passionate hockey fan), a private lake with waterfall, a flock of albino peacocks roaming the grounds, and a helipad that Nelson used for helicopter commutes to Manhattan until noise complaints from neighbors shut down the practice.

While High Winds hasn’t seen the same explosive appreciation as the Palm Beach property, the replacement cost of the amenities and the scarcity value of the land likely place it in the $30 million to $50 million range.

The annual maintenance costs alone, covering landscaping, ice rink refrigeration, security staff, and general upkeep of 130 acres, probably run into the millions.

Nicola’s $50 Million vs Brooklyn’s $10 Million

Nicola Peltz herself is worth an estimated $50 million, an impressive figure for an actress in her late twenties. But it’s an anomaly when you look at her specific filmography, suggesting the wealth comes from multiple sources.

She’s a legitimate working actress, not just a socialite playing pretend. She starred in “Transformers: Age of Extinction,” which grossed over $1 billion worldwide, and “The Last Airbender.”

While both films were critical disasters, they were massive commercial ventures where lead actresses typically earn $1 million to $3 million plus residuals.

She also had a recurring main role on “Bates Motel” from 2013 to 2017, providing steady episodic income. More recently, she wrote, directed, and starred in the independent film “Lola,” a creative venture that required significant personal capital to produce.

But the bulk of her $50 million likely doesn’t come from acting paychecks. Wealthy families use vehicles like Grantor Retained Annuity Trusts to transfer wealth to children in tax-efficient ways.

Property filings explicitly reference the “Claudia Peltz 2008 Revocable Trust” and a “2023 Non-Pourover Revocable Trust,” suggesting active estate planning designed to distribute assets to the next generation.

Nicola has almost certainly received substantial trust distributions that form the foundation of her personal wealth.

Brooklyn Beckham, by contrast, is worth an estimated $10 million. His income comes from modeling gigs, photography books, and culinary ventures like his “Cookin’ with Brooklyn” social media series and Cloud23 hot sauce brand.

He’s working and earning, but his net worth is one-fifth of his wife’s and roughly one-170th of his father-in-law’s.

The financial asymmetry in this marriage is stark. Nicola commands a personal fortune five times larger than her husband’s, and she’s backed by a $1.8 billion family war chest that makes the Beckham empire look modest.

The much-discussed “family feud” between the Peltzes and Beckhams often centers on this power dynamic. When you’re dealing with a family that controls $8.5 billion through their hedge fund and owns a single estate worth $372 million, the traditional Beckham brand leverage becomes less relevant.

The Prenup Protecting the Dynasty

Given the massive wealth disparity, a prenuptial agreement wasn’t just advisable. It was non-negotiable. Reports confirm that Nicola and Brooklyn signed a strict prenup designed to protect the Peltz “dynastic” assets.

This ensures that Trian Fund shares, the Palm Beach estate, the Bedford compound, and all trust distributions remain bloodline assets. In the event of a divorce, Brooklyn would have no claim to the Peltz family fortune.

This is standard practice in ultra-high-net-worth families. The Peltz wealth was built over decades through Nelson’s operational genius and preserved through sophisticated trust structures managed by his wife Claudia. Allowing that capital to leak out of the bloodline through marriage would violate every principle of dynastic wealth preservation.

Peltz vs Beckham: The Numbers Don’t Lie

When you line up the two families side by side, the financial picture is more balanced than the media narrative suggests. The Peltz family is worth $1.6 billion to $1.8 billion.

The Beckham family, despite starting from sports and entertainment, has built an empire worth $900 million to $1.2 billion. The fortunes are roughly comparable in size, with the Peltzes holding perhaps a 1.5 to 1 advantage at most.

But the composition tells the real story. The Peltz primary estate in Palm Beach is valued at $372 million—a single property worth more than the Beckham real estate portfolio combined, which includes their London townhouse, Cotswolds estate, and Miami properties totaling roughly $180 million.

The Peltz fortune is built on corporate ownership and hedge fund assets that compound automatically. The Beckham fortune, while brilliantly constructed, depends on continued brand management, business development, and strategic deals.

Here’s the fundamental difference: the Beckhams built wealth by transforming celebrity into equity, while the Peltzes built equity that generates celebrity-level income passively.

David Beckham brilliantly converted his sports fame into ownership stakes—Inter Miami, brand licensing deals with Authentic Brands Group, and business ventures.

But if those ventures underperform, the wealth growth slows. Nelson Peltz’s capital compounds through Trian’s investments whether he works or not, with management fees alone generating over $100 million annually.

This distinction explains the family dynamics that fascinate the tabloids. While the Beckhams live a luxurious lifestyle befitting their success, the Peltz operational scale includes private Gulfstream jets (the family operates two, at an annual cost exceeding $5 million), helicopter commutes, 130-acre private estates with indoor ice rinks, and art collections featuring Renoir and Cezanne that likely total hundreds of millions in value.

Both families are extraordinarily wealthy, but they inhabit slightly different stratospheres of the ultra-rich world.

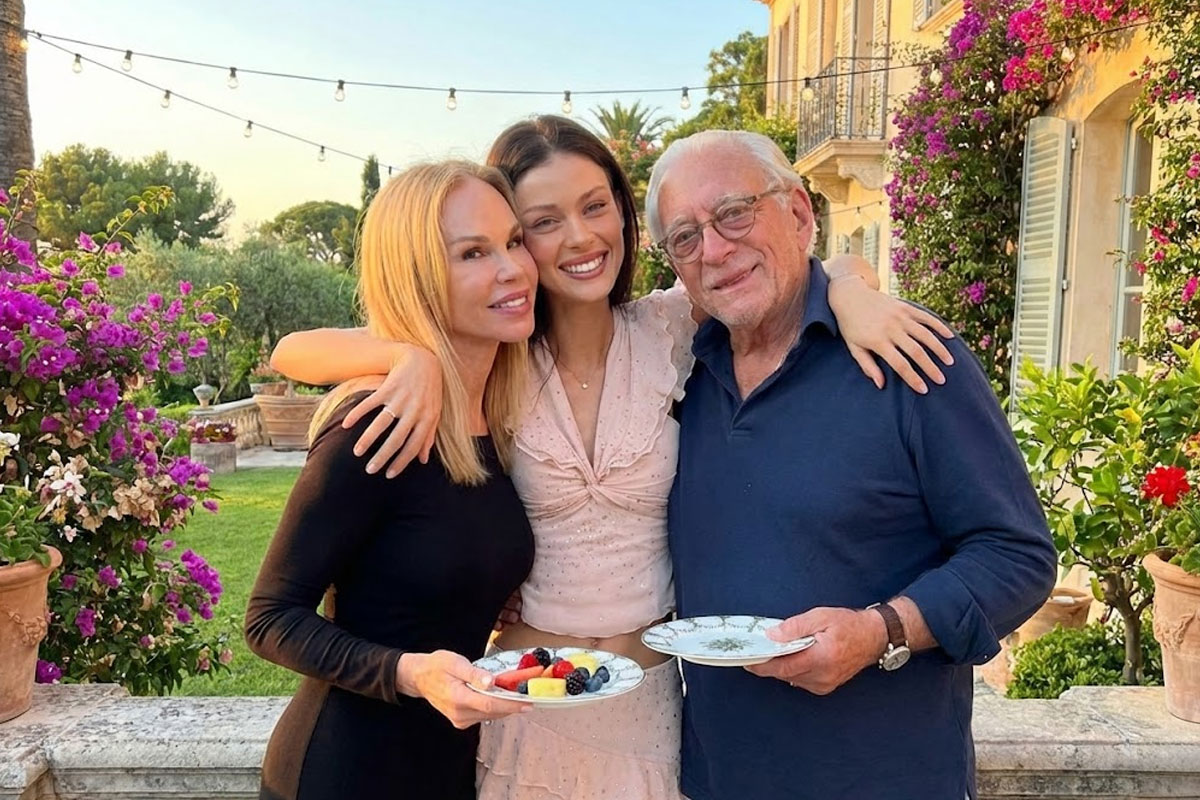

The Power Couple: Nelson and Claudia

While Nelson is the public face of the empire, his wife Claudia Heffner Peltz plays a crucial role in managing the family’s assets and lifestyle. A former fashion model, Claudia has been married to Nelson for over 35 years and is the mother of eight of his ten children, including Nicola.

Real estate filings explicitly name the “Claudia Peltz 2008 Revocable Trust” as a co-buyer of family properties, indicating her distinct ownership stakes. In ultra-high-net-worth estate planning, splitting assets between spousal trusts creates tax shelters and ensures smooth wealth transfer without probate delays.

Claudia is reportedly deeply involved in the massive renovation projects that transformed Montsorrel from a $20 million property into a $370 million compound, managing decades of construction, design oversight, and capital allocation.

The couple also channels significant wealth into philanthropy and political influence. They funded the “Claudia and Nelson Peltz Social Lab” at the Museum of Tolerance in Los Angeles.

Nelson donated $250,000 to George W. Bush’s second inauguration and has hosted fundraisers for Donald Trump, converting financial capital into political access that operates as another form of power.

What It Means to Be a Peltz Heir

Nicola Peltz represents the phenomenon the internet has dubbed the “nepo baby,” but the financial reality goes deeper than just industry connections. Her $50 million personal net worth provides independence, but her true wealth includes her beneficiary status in family trusts worth over $1 billion.

She can afford to take roles in indie films, direct her own projects, or wait years for the “right” part because she has a financial backstop that 99.9% of working actors lack.

The $4 million wedding at Montsorrel, paid for entirely by the Peltz family, exemplifies this dynamic. The venue alone (their own estate) saved millions that a normal couple would spend on rentals.

The event represented a multi-million dollar gift in kind, demonstrating the kind of lifestyle subsidy that flows from being part of a dynastic fortune.

When Nicola and Brooklyn bought a Beverly Hills home for $10.5 million in 2021 and sold it a year later for $9.5 million, taking a loss, it illustrated the difference between old money discipline and new money experimentation.

Nelson held the Palm Beach estate for 35 years and saw a 1,700% return. The younger generation flipped a property in twelve months for a loss. There’s a learning curve in managing generational wealth, and Nicola is still on it.

But ultimately, the Peltz family fortune isn’t just about the headline number. It’s about the operational mechanisms that ensure the wealth compounds across generations.

The trust structures, the tax-efficient lending against appreciating assets, the focus on defensive consumer staples, the diversification across hedge funds and hard assets.

This is institutional-grade wealth management designed to last centuries, not just decades.

When the question is “How much is Nicola Peltz’s family worth?” the answer is $1.8 billion and growing. But the deeper answer is that she’s part of a financial dynasty built on corporate activism and operational control, while she married into a dynasty built on brand equity and strategic business development.

Both families have cracked the code of generational wealth, but through fundamentally different mechanisms.

The Peltzes compound capital through corporate restructuring and real estate appreciation. The Beckhams leverage fame into ownership and equity stakes.

It’s industrial money meeting celebrity entrepreneurship, and together, they represent two distinct paths to building billion-dollar empires.